The Platinum Card® from American Express is my top recommended card for military servicemembers and spouses.

The Amex Platinum card offers unique opportunities for active duty troops to maximize their protections under law.

Learn how to apply for the Amex Platinum military on our partner's secure site

The Platinum Card® from American Express

Learn how to apply on our partner's secure site

- Annual fee of $695* See more details about military protections for you and your spouse

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership.

- Earn 5x points on airfare booked directly with airline or on amextravel.com up to $500,000 per calendar year

- Earn 5x points on prepaid hotels at amextravel.com

- $200 Annual Hotel Credit: Get $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. Note that The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month when you pay for eligible purchases with the Platinum Card® at your choice of one or more of the following providers: Disney+, a Disney Bundle, ESPN+, Peacock, Audible, SiriusXM, The New York Times, The Wall Street Journal. Enrollment required.

- $200 Uber Cash: Uber VIP status and up to $200 in Uber savings on Uber Eats and rides

- $200 Airline Fee Credit: Up to $200 in statement credits per calendar year in baggage fees and more at 1 qualifying airline

- $189 CLEAR® Plus Credit: Breeze through security with CLEAR® Plus at 45+ airports nationwide and get up to $189 back per calendar year on your membership (subject to auto-renewal) when you use your Platinum Card®.

- $300 Equinox Credit: Get up to $300 back each year on an Equinox+ subscription, or any Equinox club memberships when you pay with your Platinum Card. Enrollment required. Membership subject to auto-renewal.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership with a statement credit after you pay for Walmart+ each month with your Platinum Card. Cost includes $12.95 plus applicable local sales tax.

- Up to $100 annual Saks Fifth Avenue credit, enrollment required

- Access 40+ Centurion Lounges and 1,200+ Priority Pass airport lounge for free

- No foreign transaction fees

- The Platinum Card® from American Express – learn how to apply

- Read my full review of the Amex Platinum card for military, terms apply

You can learn why I recommend the Amex Platinum card and very important details about American Express protections for you and your spouse in this article.

If you want me to email you the details on American Express military benefits, drop in your email below. I'll just send you one email only. No spam, no newsletter. Just one email with all the details.

If you want to get the full free course, you can sign up at the Ultimate Military Credit Cards Course.

Amex Platinum Military Spouses

The Amex Platinum card is also my #1 recommended card for military spouses. Again, learn why I recommend this card for military spouses in the American Express military article.

I've been an American Express Card Member for over 15 years, since 2007. Amex offers legendary support for the military with amazing customer service and credit and charge card products. My wife and I opened over 15 American Express cards while I was active duty.

My military spouse wife had several Amex cards when I was active duty and kept most of them after I separated from active duty.

Her cards included The Platinum Card® from American Express, the American Express® Gold Card, the American Express Hilton Honors Aspire card, and the Delta SkyMiles® Reserve American Express Card.

We enjoyed all the benefits of Card Membership, including lounge access, airline fee credits, Uber credits, and much more. This is a great deal for military servicemembers and their spouses!

Podcast Episode

I recorded a podcast episode with my friend Jamie about the Amex Platinum. You can listen to it below, on Spotify, or on Apple Podcasts.

American Express Platinum Card Military

While on a TDY to France in 2013, a military buddy of mine (an Air Force Tech Sergeant) mentioned that he had the American Express Platinum card that comes with a $695 annual fee.

This Sergeant had access to great airport lounges in Amsterdam while we were travelling on TDY. While I paid $15 for an airport sandwich, he was enjoying free food and drink courtesy of his American Express card in the airport lounge.

My friend also told me about the other Amex Platinum benefits, such as airline fee reimbursement and the welcome bonus offer.

I thought the rewards program sounded good and the benefits were great, but I couldn't justify that insanely high annual fee. $695 a year was WAY too much money for a young Air Force lieutenant!

But then my friend mentioned to me that he received special protections on his American Express card.

To learn more about what these protections include, checkout my in depth American Express benefits page.

Amex Platinum Military Application

So there I was… On a deployment exercise, sitting at a bar on a military base near Gulfport, Louisiana. Behind the bar was a wooden, multi-tiered stand to keep cards of open tabs.

Of the 2 dozen cards behind the bar, over half were Amex Platinum cards. It was comical!

You could see all the Amex Platinum cards shining in their metallic glory in this low-rent bar in backwater Louisiana.

But it makes total sense – Why wouldn't a military member apply for the Amex Platinum card when it has such a substantial welcome bonus offer and excellent annual benefits?

80,000 Point Welcome Bonus Offer

The Amex Platinum card offers a 80,000 Amex Membership Reward (MR) point welcome bonus when you spend $8,000 in the first 6 months of card membership. That's only $1,333 of spending per month required.

80,000 points can be cashed out through the American Express Platinum Card® for Schwab card at 1.1 cents per point, making 80,000 Amex worth $880 cash.

You can also redeem MR points for Amazon credit, but only at .7 cents per point, making 80k points worth $560.

However, if you really want to make your 80,000 Amex points go far, you should transfer them to a travel partner, like an airline or hotel. You can earn much more than 1-2 cents per point.

Amex Travel partners include:

Aer Lingus, AeroMexico, Air Canada, Alitalia, All Nipon Airways (ANA), Cathay Pacific (Asia Miles), Avianca, British Airways, Delta, El Al, Emirates, Etihad, Flying Blue (Air France / KLM), Iberia, Hawaiian Airlines, JetBlue, Qantas, Singapore Airlines, Virgin Atlantic, Choice Hotels, Hilton Honors, Marriott Bonvoy

Amex Travel Partners

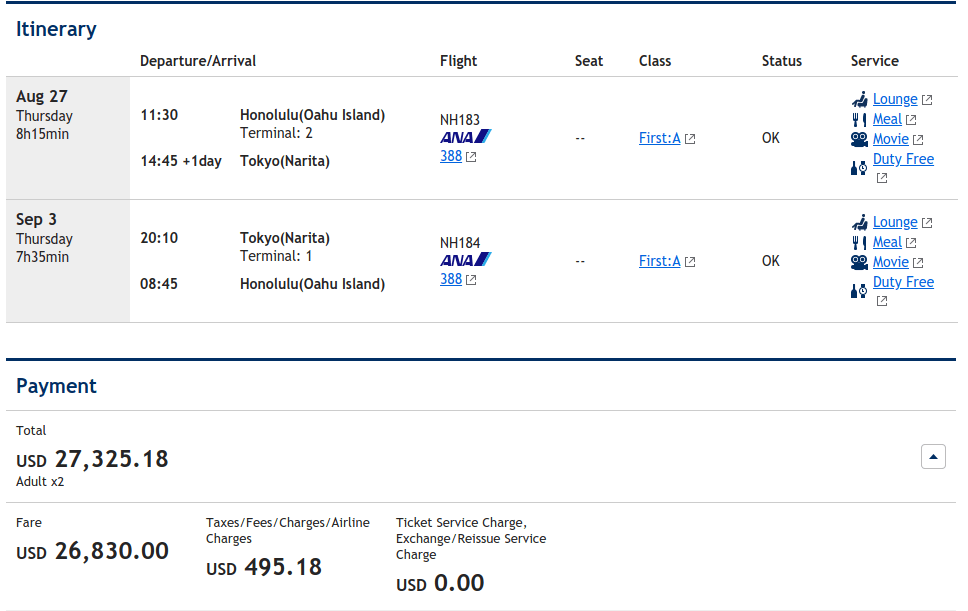

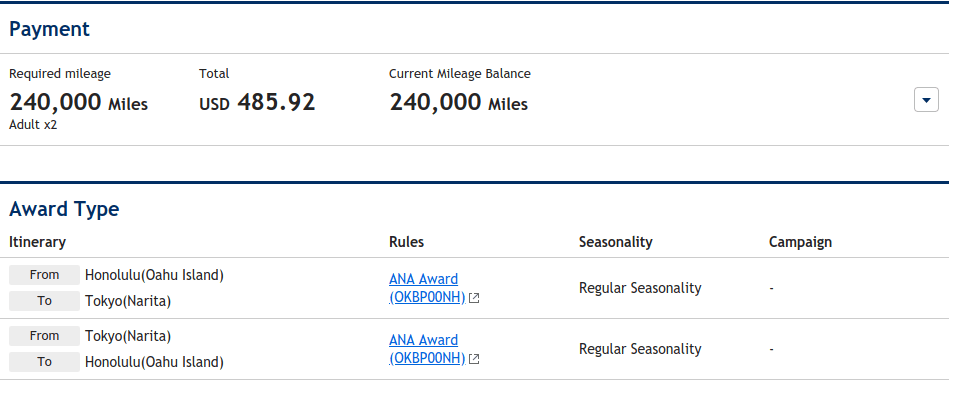

As an example, I recently cashed in 240,000 AMEX MR points for $27,000 first class flight from Hawaii to Tokyo, Japan. That's 11 cents per point! 11 cents per point means 80,000 Amex MR points would be worth $8,800!

$27,000 ANA First class tickets…

…or 240,000 AMEX MR points and $485 cash!

Even at a conservative 2 cents per point, the 80,000 Amex Plat welcome bonus is worth $1600!

$200 Uber Credit

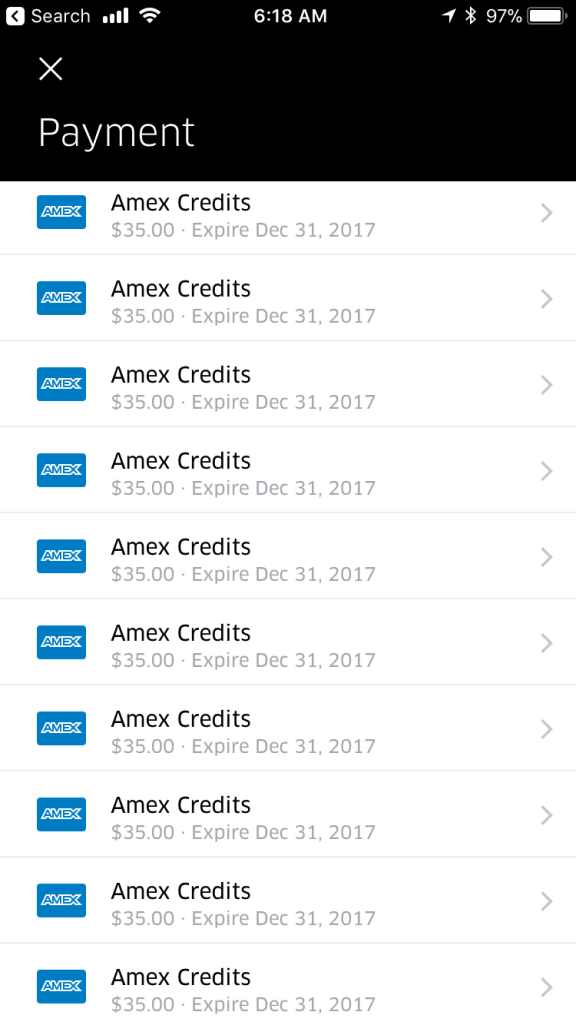

Every month, like clockwork, I get a $15 credit in my Uber account, just for keeping my no annual fee Amex Platinum card around. If you have more than one Platinum card or your spouse has a Platinum card, you can stack the credits as well. In December AMEX hands out $35 in Uber credit.

When I lived in the United Arab Emirates for 2 years and could not use the credit, I sent UberEats to family and friends back home. Don't let those credits go to waste! The credits do not carry over month to month.

$200 Annual Hotel Credit

The Amex Platinum card come with up to $200 per year in hotel credits. You must book a prepaid hotel in the Amex Fine Hotels & Resorts or The Hotel Collection through the AmexTravel.com portal. Amex Fine Hotels & Resorts can be a one night stay. The Hotel Collection requires a two night minimum stay. You will receive the credit on your statement in a few days after making the purchase.

$240 Annual Digital Entertainment Credit

You can earn up to $240 per year in digital entertainment credits. The credit paid is paid as a $20 monthly statement credit on eligible subscriptions or purchases on any of these services:

- Audible

- Peacock

- SiriusXM

- The New York Times

- Disney+ (added April 6, 2022)

- The Disney Bundle (added April 6, 2022)

- ESPN+ (added April 6, 2022)

- Hulu (added April 6, 2022)

I use mine for Audible and the New York Times crossword.

The Platinum Card® from American Express

Learn how to apply on our partner's secure site

$200 Airline Fee Credit

You pick an airline of your choice every year on the Amex website. You can spend $200 on incidentals or fees on that airline and get the reimbursement posted to your credit card statement.

$100 Global Entry Credit or TSA PreCheck

Since all military personnel already have TSA Pre-Check with their DOD ID numbers (the number on the back of your CAC), it makes sense to apply for the Global Entry program. With the Platinum card, your $100 sign up fee is reimbursed.

Global Entry gives you fast track access to the US when returning from overseas. This can be really nice when coming back to the US from OCONUS. The last thing you want after an economy class flight is to wait in a long line for Customs and Immigration.

Centurion & Priority Pass Lounge Access

The Centurion Lounges offered by American Express have some of the best food and drink available in lounges in the US. You can get into all of them for free with your Platinum card.

The Platinum Card® from American Express also gives you complimentary membership in the Priority Pass program, giving you access to an additional 1200+ airport lounges around the world.

When you're travelling internationally or domestically, it's really nice to not have to worry about food, where you're going to charge your phone, or if the bathrooms are going to be nice. Lounge access takes you far from the madding crowds and gives you a little bit of peace in your travels.

Marriott Bonvoy Gold Elite + Hilton Gold Status

The hotel elite status you get automatically just for having a Platinum card make this card a no-brainer. As a military servicemember, chances are pretty good that you travel for work or fun. Here are my top recommended hotel credit cards for military.

There is almost always an Marriott or Hilton property near your TDY location or your vacation spot. Since SPG and Marriott just merged you should have no problem cashing in on this benefit.

You will earn extra points when you stay at these properties because of your status and you might get freebies like breakfast, room upgrades, or other perks.

To get even better Marriott and Hilton Elite status, check out the no annual fee Marriott credit cards for military and automatic Diamond status (the highest offered) on the Hilton credit cards for military.

No Foreign Transaction Fees

The best luxury travel cards offer no foreign transaction fees. Most of the cards in my wallet have no foreign transaction fees. If you are stationed OCONUS or travel a lot OCONUS, you need to make sure you always have a no foreign transaction fee card in your wallet.

It just doesn't make sense to pay foreign transaction fees, especially when you get an great travel rewards card like the Amex Platinum Card with no annual fee. Do the math and don't pay extra when you do not have to!

Final Thoughts on the Amex Platinum Military

American Express offers a unique opportunity to US servicemembers to earn a ton of Membership Rewards points, Marriott Bonvoy points, Hilton Honors points, and Delta Skymiles.

You could earn hundreds of thousands or even millions of points through regular spending, welcome bonuses, and referral bonuses with your Amex cards.

Military servicemembers and spouses can learn more about American Express protections for you and your spouse.

These travel and cash back Amex cards can open up business class and first cla

READ MORE 👁️ https://militarymoneymanual.com/amex-platinum-military/